Since its inception, EDPR has been performing a strategy focused on selective growth, by investing in quality projects with predictable future cash-flows, and seamless execution, supported by core competences that yield superior profitability, all embedded within a distinctive and self-funding model designed to accelerate value creation. As a result of undertaking such strategy, at the same time flexible enough to accommodate changing business and economic environments, EDPR remains today a leading company in the renewable energy industry.

Selective growth

With approximately 11.4 GW of installed capacity across 14 countries, as of December 2019, EDPR’s strategy to grow profitably and create solid value is based in a low risk strategy when it comes to energy prices. This is achieved with the pursuit of new projects with long-term PPAs secured or that have been awarded with long-term contracts under stable regulatory frameworks, as well as exhibiting above portfolio average load factor.

Therefore, EDPR is able to define its future in advance and achieve solid visibility of the projects’ stable cash-flow stream.

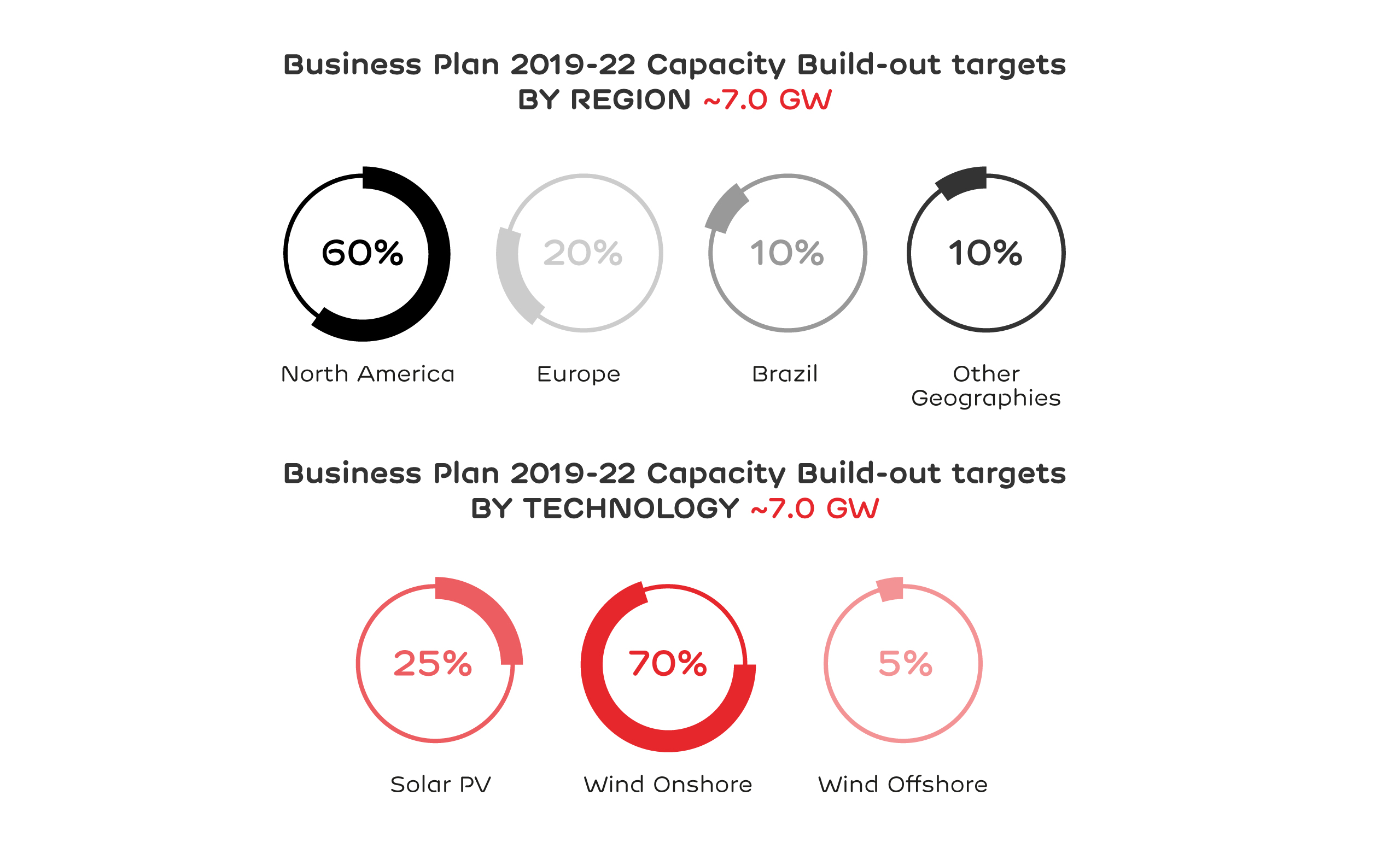

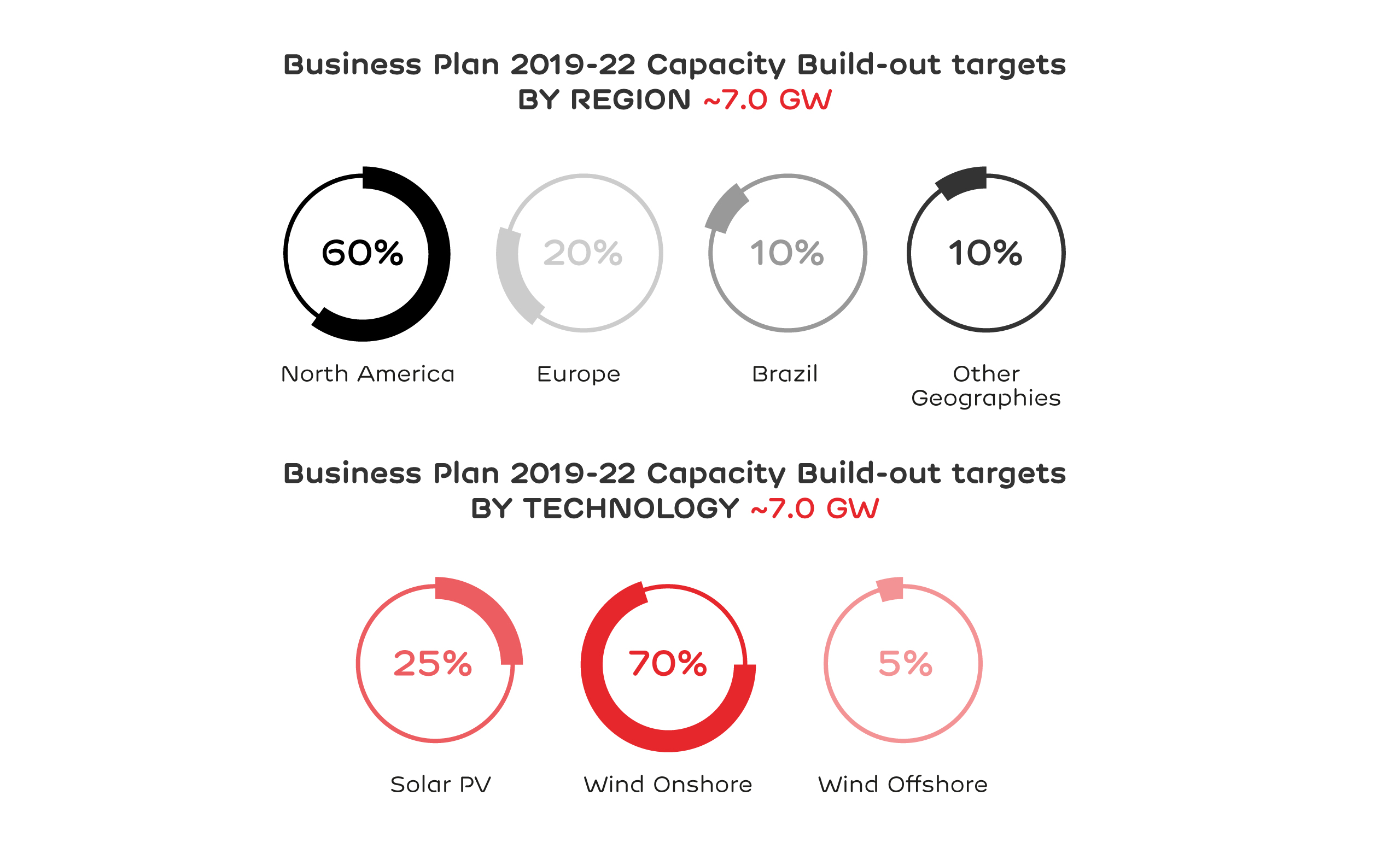

For the 2019-22 period, EDPR plans to add 7 GW of new capacity, of which 5.2 GW are already secured and to be installed until 2022.

EDPR will diversify geographically and technologically growing on wind onshore, offshore and solar along with the entrance in new markets.

Self-funding Business

EDPR has a target of more than €8.0 billion of investments for the 2019-22 period, which will be supported by the self-funding model that substitutes the initial financing strategy that depended on corporate debt from EDP, the major shareholder of EDPR and allows the company to create value while recycling capital. In capital intensive businesses, such as renewable energy, it is crucial to have visibility on the company’s ability to raise funds to add new value accretive projects when a project is still in the final stages of development. With this mind-set it is of the upmost importance to make sure the retained cash-flow generated by the assets already installed is maximized as this will be the main source of funds for the company’s growth.

The model relies on a combination of the cash flow from operating assets, US tax equity structures, and EDPR’s strategy of selling stakes in projects in operation or under development.

EDPR external financing comes typically from tax equity structures in the US or through project finance structure or even non-euro currency projects. The case of tax equity in the US enables an efficient utilization of the benefits provided by the project and in the case of project finance, mainly in Brazil, contracts of long-term debt in local currency at competitive costs are attained to mitigate the refinancing risk and to reduce the foreign exchange risk by having a natural hedge between revenues and expenses.

Until 2017 these transactions involved the company selling minority stakes at project level while maintaining full management control, called Asset Rotation. In 2018 EDPR closed its first Sell-down transaction. Under this strategy, EDPR sells majority stakes in projects in operation or in late stage of development, allowing the company to grow faster by unlocking its growth potential.

As of 2019, EDPR already announced €1.2 billion out of the >€4.0 billion of sell down proceeds for 2022, representing 33% of such target.

Operational Excellence

Optimizing performance throughout a project’s life-cycle is a key priority at EDPR. EDPR’s superior know-how, with a team fully dedicated to wind resource analysis, and expertise guided by internal models drives operational metrics above the market, resulting in premium net capacity factors and high levels of availability.

EDPR’s focus on high operational efficiency metrics, with a comprehensive O&M strategy, is crucial to keep costs under control and key to achieve quality financial metrics.

1. Origination: For the first step of the chain, EDPR realizes a Site ID with the posterior process of granting all the securing and permitting required for it. Transmission, interconnection and off taking contracts are the last part of this Origination phase.

2. Execution: The Layout optimization and the proprietary model are part of the execution phase, as well as the engineering performed by EDPR team, where it is showed the company technical know-how acquired through years of experience in the business, along with a distinctive procurement strategy.

3. Operations: Once the project is commissioning, the operations are key for being able to keep creating value, with labours as wind farm performance upgrading and energy sales revenues maximization as well as implementing a comprehensive O&M strategy, defined by internalization of O&M activity, as EDPR has been doing for the last years.

In order to feed and support this strategic pillar EDPR set 3 operational targets for the 2019-22 period:

from addictions of competitive projects

technical expertise to maximise output

CAGR 18-22